It's that time of year when we remember to give thanks for our blessings in life. I am excited to share that I recently embarked on a new journey in a full time Organizational Development Specialist role, and I am pursuing an Instructional Design Graduate Certificate through University of Wisconsin Stout's distance learning program. Thanks to all that continue to support me as I strive to achieve my goals and always remain positive!

eLearning MC

Adult Learning and Training, eLearning Design and Development

Workforce Surveys, Human Resources, and Project Management

Saturday, November 22, 2014

Good news and new directions

It's that time of year when we remember to give thanks for our blessings in life. I am excited to share that I recently embarked on a new journey in a full time Organizational Development Specialist role, and I am pursuing an Instructional Design Graduate Certificate through University of Wisconsin Stout's distance learning program. Thanks to all that continue to support me as I strive to achieve my goals and always remain positive!

Wednesday, July 30, 2014

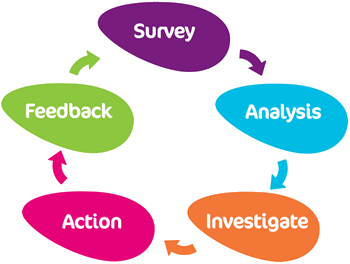

Project Management: Enterprise Surveys

Here is a broad outline of the various decisions/considerations in the survey cycle:

- Survey Format/Web/Paper - Does your target audience have web/email access and/or can you provide computer kiosks? Paper should be avoided due to high cost and strict logistics.

- Languages/Translations - How many languages, who will coordinate translations, and how much time will be needed for the entire process, including quality control checks?

- Timeframe/Length of Data Collection - When do you want the survey to launch: Annually? Bi-Annually? Quarterly? How long will each data collection window be: 2 weeks? 3 weeks?

- Survey Content/Paths/Design - What are your current business successes/challenges and how will survey content align with feedback/data collection results you hope to gain? Will survey content be universal, or will you tailor content for different levels/departments?

- Confidentiality/Ethics/Access - Will the survey be anonymous or individually authenticated? What level of confidentiality is required by all parties, and how will confidentiality affect end-user response rates? What is the minimum number of participants required to share results?

- Branding/Logo/Communications - Will you use existing templates, or require custom branding and design? How will you communicate to your audience before, during, and after the survey?

- Participant Files/Hierarchies - Will any participant information (Name, Email, Level, Department, etc.) be provided in advance, or will it be collected during the survey? Will you need to produce participant hierarchies for response rate or reporting purposes?

- Qualitative/Quantitative Data Collection - Will survey data be collected in quantitative scales (i.e. rating of 1-10 or Likert scale), or will survey data include qualitative open ended comment responses that need to be analyzed for word groupings and themes?

- Data Analysis/Cuts/Graphic Views - What statistical data analyses will be performed, and how will the results be presented: bar charts, line graphs, heat maps, conditionally formatted tables, infographics, word clouds, etc.?

- Online/Offline Reporting/Delivery Method - Who will receive data analysis reports and how will access be monitored? How will data analysis reports be delivered: via internal or external shared website, mobile device, email/paper?

- Training/Help Desk Support/Action Planning - Will the end-user need to be trained to access the survey or read reports, will a dedicated help desk be required at any stage in the process, and what will be required of users receiving reports post-survey to address the findings and outcomes?

Saturday, June 28, 2014

Human Resources: Workforce Innovation

"We now have the ability to recognize and analyze trends that can literally predict behavior, [...] match capabilities to marketplace needs, [...] and act on time-tested insights to drive business outcomes" (IBM, 2013).

Workforce Surveys have such broad reaching capabilities. With the right content, confidentiality, and response rates, organizations can equip themselves with the data needed to drive the most important business decisions. If this topic intrigues you, I encourage you to download the CEB whitepaper 'Rethinking the Workforce Survey' here - http://bit.ly/1qWtEW1.

In the emerging work environment, we should focus on using survey data to determine how workforces use technology to network and collaborate among teams, departments, branches, etc. Data collected about leaders is often upward feedback, and we determine how leaders are able to work successfully within their teams, but without a 360 degree perspective, the data might not be so informative about how successful a leader works with leaders of other networked teams.

"What if organizational interventions were designed around informal networks of employees?" (Mastrangelo, 2013). Network performance is made up of individual performance within the network, and identifying the competencies of the most highly networked leaders is critical to organizational and leadership development. There needs to be strategic, cultural, and goal alignment across teams and it begins with a focus on network competencies and technology.

Resources:

Mastrangelo, P. CEB (2013) 'Want Employees to Work Smarter? 3 Ways to Foster Network Performance' http://bit.ly/1qENyT7

IBM (2013) 'Redesigning work creates a smarter workforce' http://ibm.co/1vhTRfx

Workforce Surveys have such broad reaching capabilities. With the right content, confidentiality, and response rates, organizations can equip themselves with the data needed to drive the most important business decisions. If this topic intrigues you, I encourage you to download the CEB whitepaper 'Rethinking the Workforce Survey' here - http://bit.ly/1qWtEW1.

In the emerging work environment, we should focus on using survey data to determine how workforces use technology to network and collaborate among teams, departments, branches, etc. Data collected about leaders is often upward feedback, and we determine how leaders are able to work successfully within their teams, but without a 360 degree perspective, the data might not be so informative about how successful a leader works with leaders of other networked teams.

"What if organizational interventions were designed around informal networks of employees?" (Mastrangelo, 2013). Network performance is made up of individual performance within the network, and identifying the competencies of the most highly networked leaders is critical to organizational and leadership development. There needs to be strategic, cultural, and goal alignment across teams and it begins with a focus on network competencies and technology.

Resources:

Mastrangelo, P. CEB (2013) 'Want Employees to Work Smarter? 3 Ways to Foster Network Performance' http://bit.ly/1qENyT7

IBM (2013) 'Redesigning work creates a smarter workforce' http://ibm.co/1vhTRfx

Thursday, June 19, 2014

Workforce Surveys: Introduction

Time to reflect on my experience with CEB Workforce Surveys & Analytics to this point. Sharing this knowledge is certainly past due, but I hope you find my insights valuable none-the-less! To start, I work with two distinct types of surveys:

Employee Opinion Surveys (EOS)- Sample or census survey in which content is used to collect employee opinions about key business strategies, decisions, processes, etc. and determine the effectiveness and alignment of these initiatives via the performance of the business and the engagement of its employees.

360 Degree Feedback Surveys (360) - Sample survey in which leaders gain 360 degree feedback from multiple levels of the organization (upward, downward, peer). Content is specific to assessing an individual in relation to the key professional development and leadership metrics of the organization.

Consultants work to develop survey content/response scales/metrics that align with an individual business's needs. In almost all cases, individual questions are categorized into mega themes, and open-ended questions are coded into mega topics for reporting purposes.

Survey data is often compared to historical data, internal benchmark data, and/or external normative data in order to gauge positive and/or negative progress on company initiatives and compare results to industry best practices.

Subscribe to:

Posts (Atom)